Investing in land requires more than just good timing—it demands clarity, documentation, regulatory awareness, and long-term vision. Over the last few years, Dholera SIR (Special Investment Region) has emerged as one of India’s most talked-about greenfield development zones, attracting investors from across the country and NRIs alike.

This blog presents a clear, structured checklist to help investors evaluate land investment opportunities in Dholera SIR with confidence, transparency, and informed decision-making.

Short Introduction to Dholera SIR and Its Area

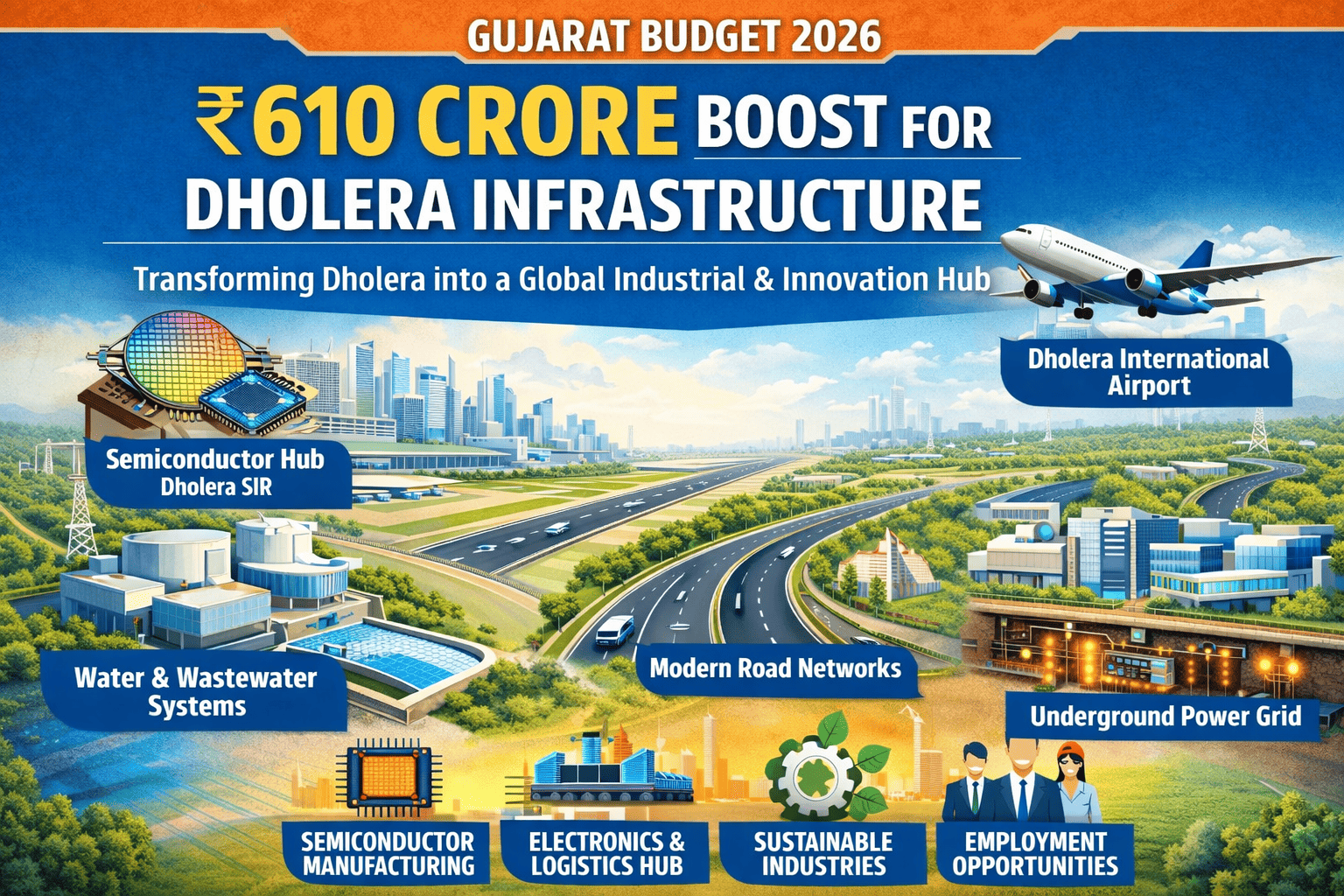

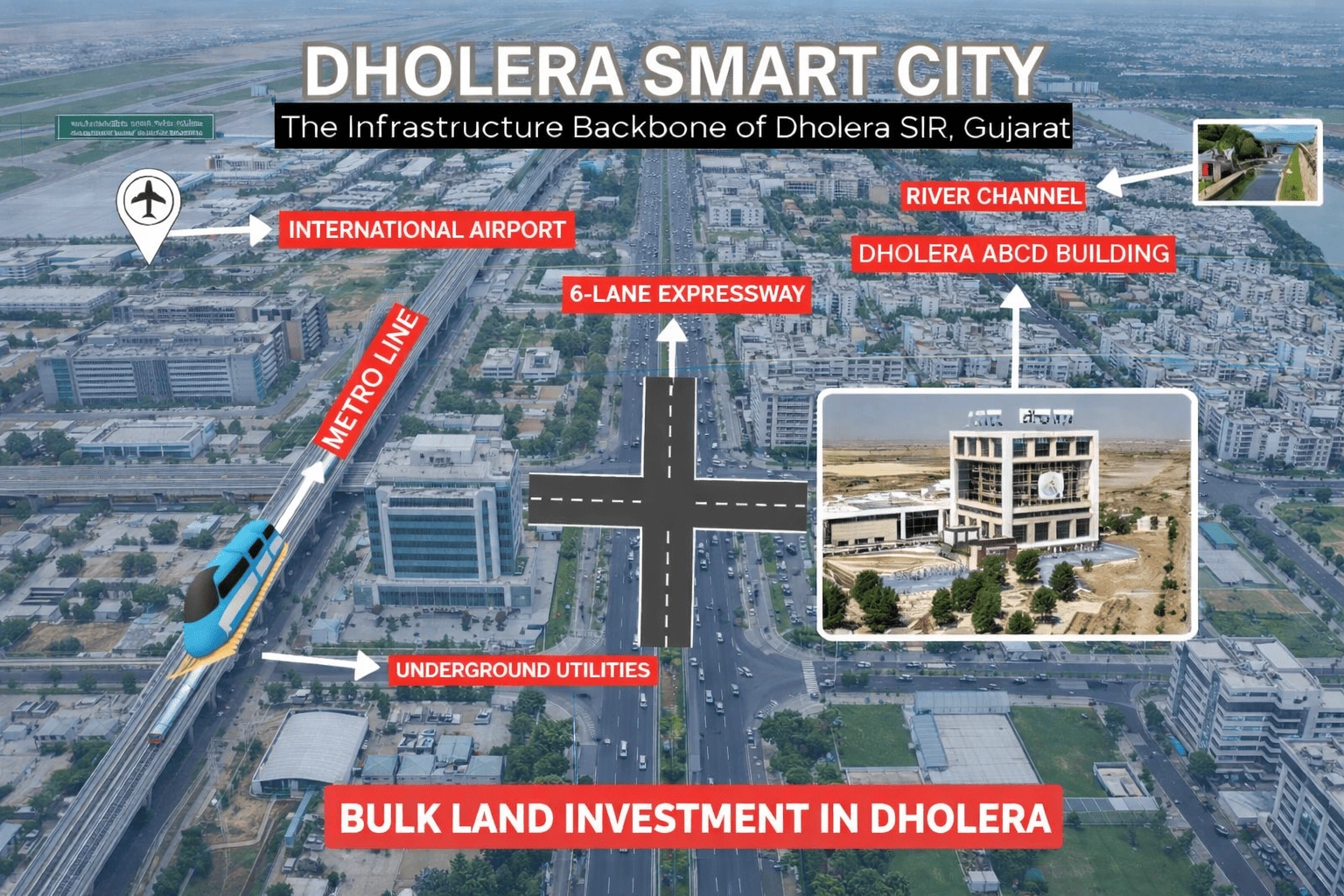

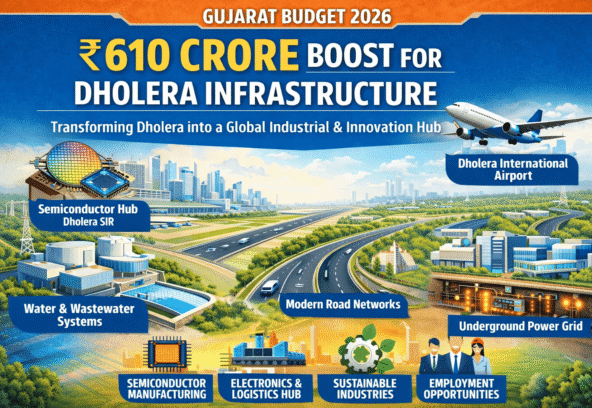

Dholera SIR is India’s first planned greenfield smart city, developed under the Delhi–Mumbai Industrial Corridor (DMIC). Strategically located in Gujarat, it is being developed as a global manufacturing, industrial, and urban hub with modern infrastructure and advanced planning.

Spread across approximately 920 square kilometers (over 227,000 acres), Dholera SIR is designed to support industrial zones, residential areas, logistics hubs, commercial districts, and social infrastructure. Unlike unplanned urban growth, this region follows a Town Planning–based development model, ensuring organized expansion, legal clarity, and infrastructure readiness.

The scale, government backing, and long-term vision make land investment here fundamentally different from conventional real estate markets.

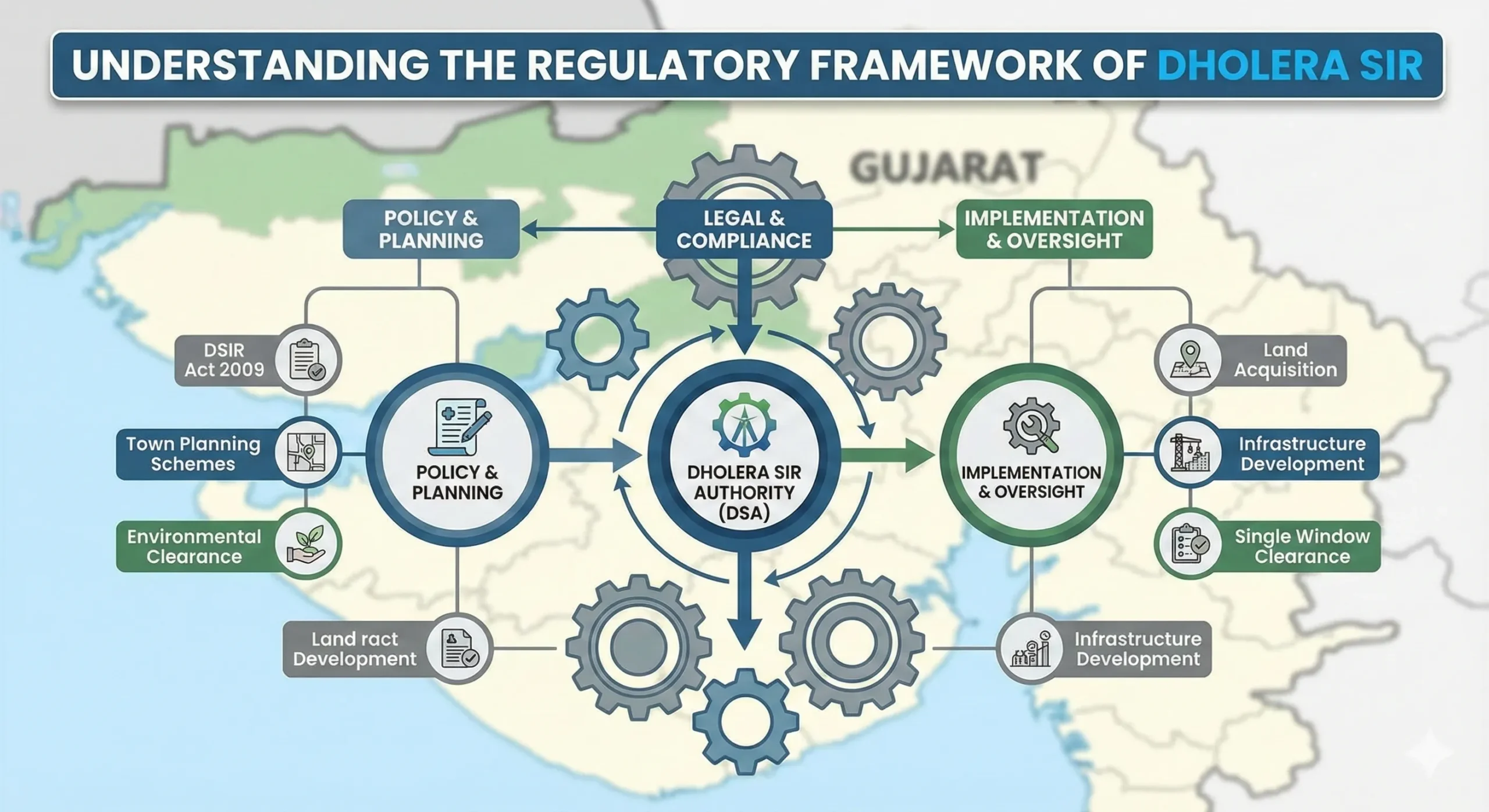

Understanding the Regulatory Framework of Dholera SIR

Before investing, it is essential to understand that Dholera SIR is not a private township—it is a statutorily notified region governed under the Gujarat Special Investment Region Act.

Key regulatory aspects include:

- Development is executed through a Special Purpose Vehicle (SPV) with state and central government participation

- Land development follows Town Planning (TP) Schemes

- Infrastructure provisioning is planned before large-scale habitation

- Clear zoning rules for residential, industrial, and commercial usage

This structured regulatory environment reduces speculative risk and brings long-term stability to land investments within the region.

Checklist Step 1: Verify NA (Non-Agricultural) Status

One of the most critical checks for investors is confirming whether the land has Non-Agricultural (NA) status.

Why NA matters:

- Only NA land can be legally used for residential or commercial purposes

- It ensures compliance with development norms

- It reduces future conversion delays and legal complications

Always verify that the NA permission is officially granted and documented. Avoid land offerings where NA approval is “promised later” without written proof.

Checklist Step 2: Check for Required NOCs

In Dholera SIR, additional No Objection Certificates (NOCs) may be required depending on land location and zoning.

Important NOCs may include:

- Infrastructure or planning authority clearance

- Environmental or zoning compliance, if applicable

- Confirmation of inclusion under the correct TP Scheme

A verified NOC ensures that the land aligns with the master development plan and avoids future regulatory hurdles.

Checklist Step 3: Confirm Survey Number Authenticity

Every land parcel in Gujarat is identified by a survey number, which acts as its legal identity.

Investors should:

- Match the survey number with government land records

- Confirm land boundaries and area details

- Ensure the survey number is free from disputes or overlapping claims

This step is essential to ensure the land physically and legally exists as described.

Checklist Step 4: Review TP Documents and FP Numbers

Dholera SIR operates on a Town Planning (TP) Scheme model, which is a major advantage for investors.

Key documents to review:

- TP Scheme document: Shows planned roads, amenities, and land redistribution

- Final Plot (FP) number: Assigned after TP implementation

An FP number indicates that the land is part of an approved planning scheme and is aligned with future infrastructure layouts. This significantly enhances long-term value and development clarity.

Checklist Step 5: Title and Ownership Verification

Clear title is the foundation of safe land investment.

Before proceeding:

- Conduct a full title search for at least 30 years

- Ensure the seller has legal ownership rights

- Check for mortgages, legal disputes, or pending claims

Engaging a professional legal advisor for due diligence is strongly recommended at this stage.

Checklist Step 6: Evaluate Developer Reputation

In a large region like Dholera SIR, the credibility of the developer or facilitator plays a crucial role.

A reputed developer ensures:

- Transparent documentation

- Genuine land parcels

- Assistance with legal verification

- Long-term accountability

Mid-way through the market evolution, developers like Angel Nova Group have gained recognition for focusing exclusively on Dholera SIR. Their approach emphasizes TP-based plots, transparent dealings, and investor education rather than short-term speculation. Working with experienced players reduces execution risk and enhances confidence, especially for first-time investors.

Checklist Step 7: Connectivity and Location Advantages

Location within Dholera SIR matters as much as the city itself.

Key connectivity advantages include:

- Direct access to the Ahmedabad–Dholera Expressway

- Proximity to the upcoming Dholera International Airport

- Integration with DMIC freight and industrial corridors

- Planned metro and logistics connectivity

Plots closer to major infrastructure nodes—such as expressways, industrial zones, or airport influence areas—typically offer stronger long-term appreciation.

Checklist Step 8: Infrastructure Timeline Awareness

Understanding when infrastructure becomes operational is as important as knowing what is planned.

Investors should assess:

- Current infrastructure status (roads, utilities, drainage)

- Phased development timelines

- Government-announced milestones

Dholera SIR follows a phased execution model, meaning returns are best viewed from a medium-to-long-term perspective rather than short-term flips.

Suitable Investment Options Within Dholera SIR

Depending on goals and risk appetite, investors can consider:

Residential Plots

Ideal for long-term holding and future development as urban habitation expands.

Industrial or Logistics Zones

Suitable for business-oriented investors aligned with manufacturing and supply-chain growth.

Strategic Land Banking

For investors seeking capital appreciation over a 5–10 year horizon as infrastructure matures.

Each option should be matched with clear documentation, zoning clarity, and development alignment.

Final Thoughts: Investing with Structure, Not Speculation

Land investment in Dholera SIR is not about hype—it is about process, planning, and patience. By following a structured checklist covering regulatory compliance, documentation, location analysis, and developer credibility, investors can significantly reduce risk while positioning themselves for long-term growth.

As India’s first planned greenfield smart city continues to evolve, informed decision-making will separate successful investors from speculative buyers. With the right due diligence and a long-term outlook, land investment in this region can become a strategic addition to a diversified portfolio.