Blog

When people talk about investing in Gujarat, one name keeps coming up again and again: Dholera. It is not just another plotted development story—Dholera is planned as a large-scale smart city with industrial, logistics, and infrastructure development happening step by step. That’s why many buyers are now asking a practical question about Expected ROI & Price Appreciation in Dholera Smart City—how much return can investors realistically expect, and how strongly property prices may appreciate in the coming years?

This blog breaks down Dholera investment return analysis in a simple, realistic way—without over-promising. You’ll understand what drives growth, what can slow it down, how to estimate returns, and how to choose the right location and plot type for better upside.

Why Dholera is seen as a long-term appreciation market

Price growth in real estate mostly depends on two things:

- Demand (people and businesses wanting land)

- Confidence (clear development + good connectivity + legal clarity)

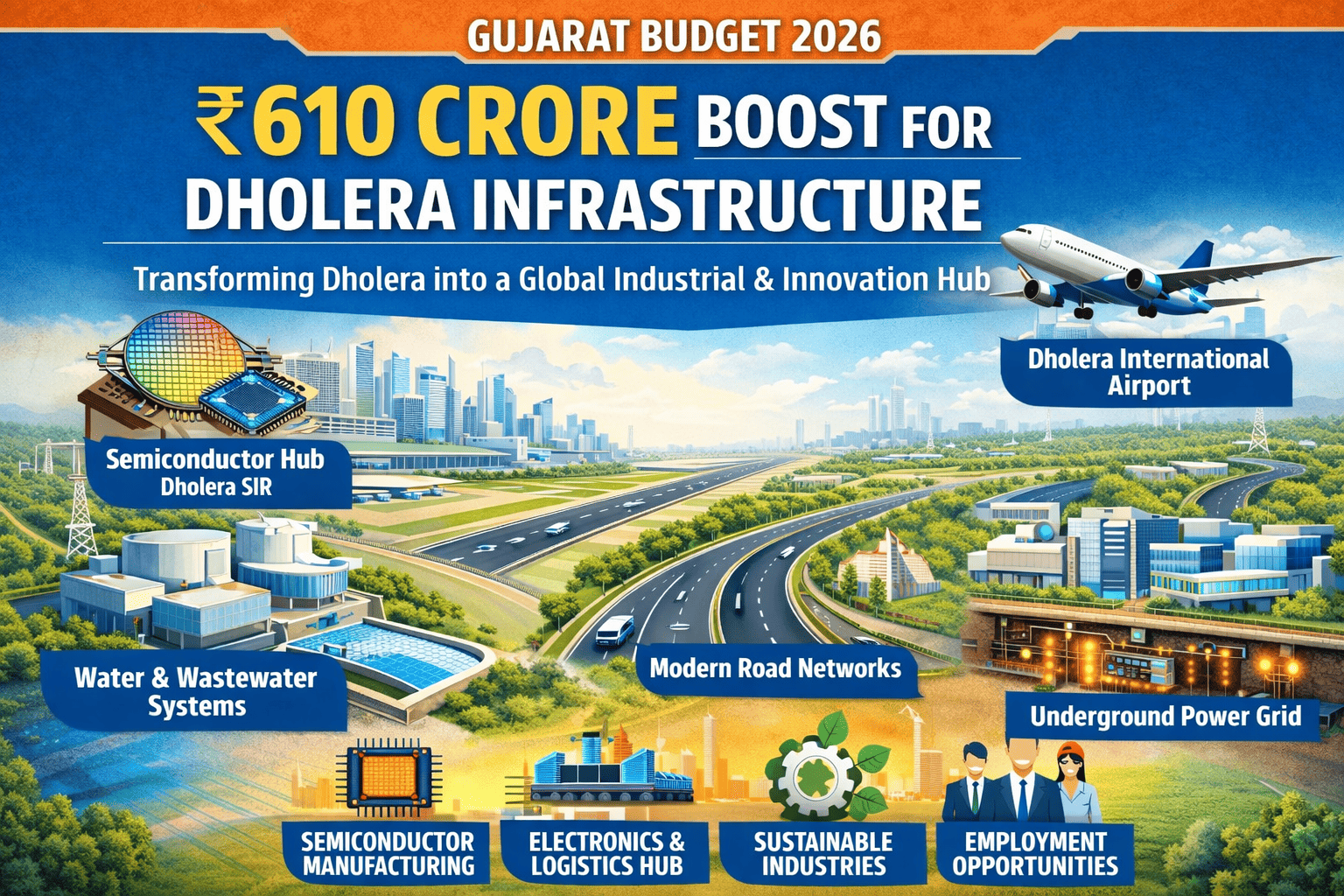

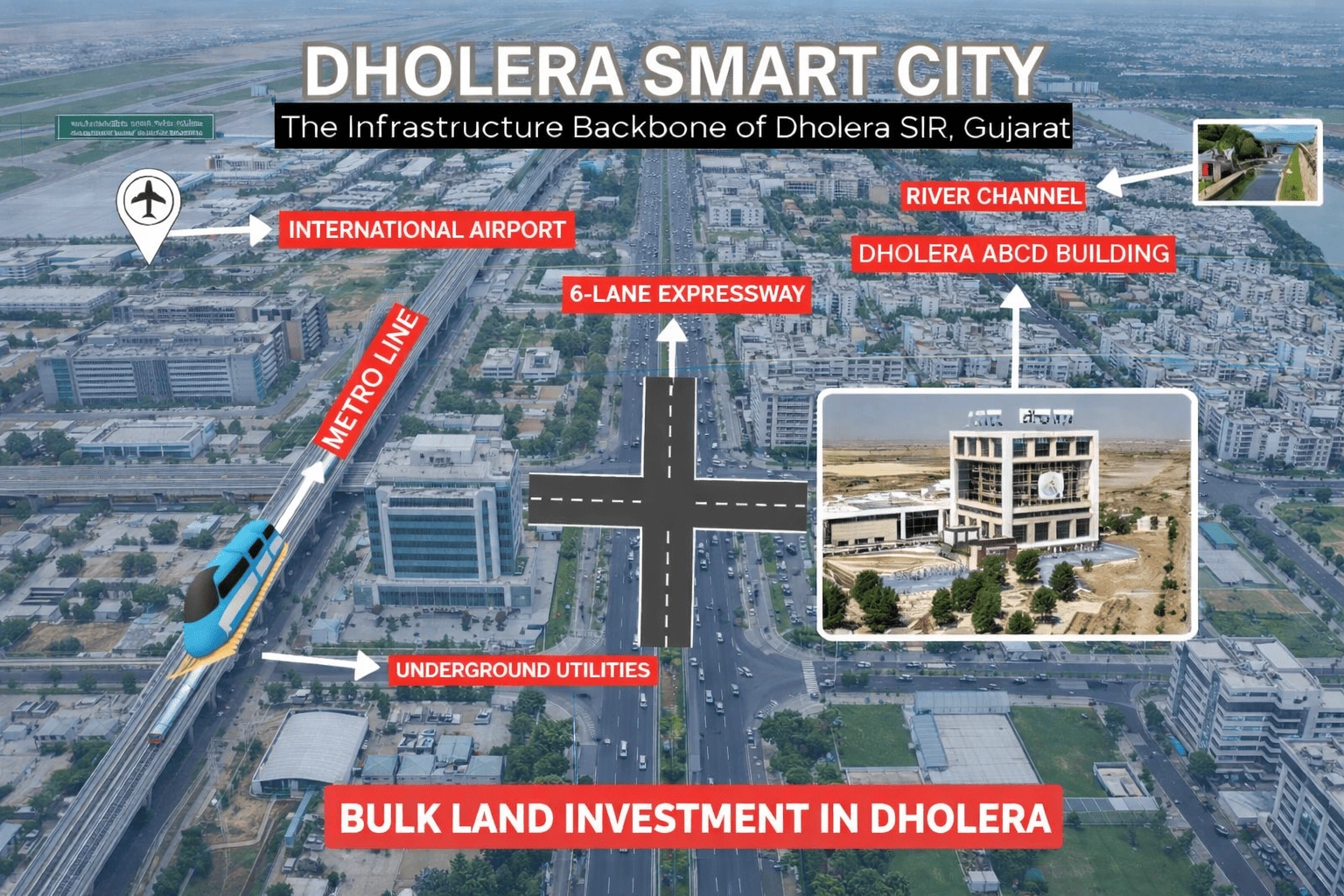

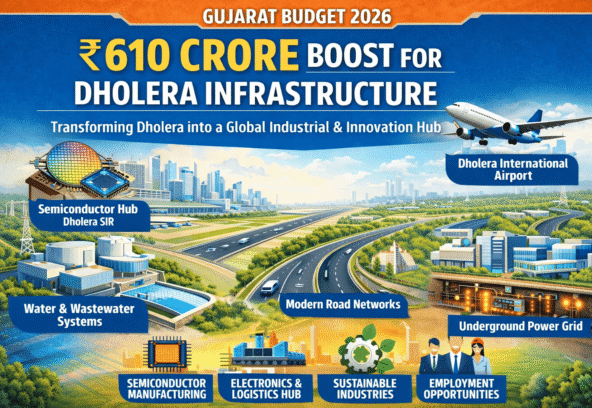

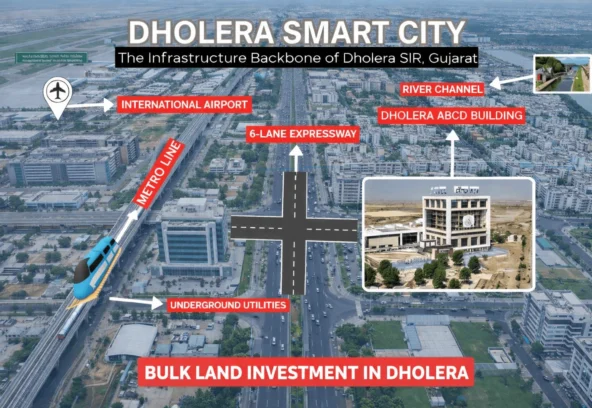

Dholera’s development model is planned around infrastructure and industrial expansion. When key infrastructure like highways, utilities, and public facilities are built, land becomes more usable. And when industries, companies, and employment start growing, demand increases.

So, the future property value in Dholera is linked to real development progress—not just marketing.

Understanding “ROI” in Dholera: what returns really mean

When we say dholera smart city ROI, people usually mean one (or both) of these:

1) Price Appreciation ROI

If you buy a plot today and sell after 3–5 years at a higher price, that difference is your appreciation return.

2) Opportunity ROI

Some investors buy early because they believe the price will rise faster than traditional markets. In that case, ROI is also about “being early in a growth zone.”

For most buyers, Dholera is mainly an appreciation-driven investment, not a rental-income market like residential flats in metro cities.

Key drivers of Dholera land appreciation in 5 years

Here are the biggest factors that can influence dholera land appreciation in 5 years:

1) Infrastructure completion and connectivity

Real estate values rise when travel time reduces and connectivity becomes smooth. In Dholera’s case, connectivity upgrades (highways, expressway links, and overall road network) play a direct role in making the region more attractive for business and living.

2) Industrial growth and job creation

Land appreciates faster when industries create local demand—housing, services, warehouses, and supporting businesses. A growing industrial ecosystem increases confidence, and confidence increases buying demand.

3) Government planning and town development

Because Dholera is planned, growth is usually more structured than random expansion. Planned zones, utilities, and long-term city design can support sustained appreciation, especially in better-located pockets.

4) Investor psychology and market cycles

Sometimes prices move because of development news, major project milestones, or market sentiment. This can cause short-term spikes. But long-term returns usually come from actual progress on the ground.

Growth forecast: realistic way to think about it

Many people search for dholera smart city growth forecast expecting one fixed number. In reality, real estate doesn’t move in a straight line. A better way is to think in scenarios:

Scenario A: Slow & steady growth

- Development continues gradually

- Prices rise slowly each year

- Best for investors who can hold patiently

Scenario B: Development milestone boost

- A major project milestone increases confidence

- Demand rises in key pockets

- Prices move faster for a period

Scenario C: Mixed growth

- Some zones perform well, others stay flat

- Good location plots appreciate more

- Average market looks “okay,” but smart buyers do better

So instead of asking only “how much return in Dholera investment,” ask: Which location has the strongest demand triggers over the next 5 years?

What impacts returns the most: location + legality + timing

If you want better ROI, focus on these three:

1) Location and access

Even inside the same city region, appreciation varies by connectivity, nearby development, and ease of access.

Tip: Prioritize plots with better approach roads and closer links to major development areas.

2) Clear paperwork and legal clarity

A clean title and proper documentation reduce risk and increase resale demand. Many investors lose time and profit when documentation is not clear.

Tip: Always verify survey details, approvals, and the developer’s documentation process.

3) Entry price and holding period

Buying at the right price matters. Overpaying reduces ROI. Also, most appreciation stories need time—usually 3–7 years.

Tip: If you can hold longer, you usually get better results, especially in developing markets.

How to do a simple Dholera investment return analysis

You can do a basic ROI estimate without complicated math:

- Buy price today (per sq. yard or total plot cost)

- Expected resale range after 5 years (use conservative, normal, and optimistic assumptions)

- Costs to include

- Registration/stamp duty (if applicable)

- Basic development/maintenance charges (if any)

- Brokerage or selling costs (future)

Then compare:

(Expected selling value – total cost) = profit

Profit ÷ total cost = ROI

This simple method helps you stay realistic instead of depending on “guaranteed return” claims.

Mistakes that reduce ROI in Dholera

If you want good expected ROI in Dholera Smart City, avoid these common mistakes:

- Buying only because it is “cheap” (cheap plots can stay cheap)

- Ignoring location quality and access

- Not checking documentation properly

- Expecting quick returns in 6–12 months

- Assuming all projects/plots will appreciate equally

In developing markets, the right plot can perform very well, and the wrong plot can remain stagnant for years.

Who should invest in Dholera for 5-year appreciation?

Dholera can suit you if:

- You want a long-term investment (3–7 years)

- You are comfortable with development-based growth

- You want to diversify beyond metro city property

- You prefer plotted land for appreciation potential

It may not suit you if:

- You need guaranteed short-term returns

- You want monthly rental income immediately

- You do not want to deal with paperwork verification

Conclusion: Expected ROI is possible, but smart selection matters

So, what’s the final answer to how much return in Dholera investment? There isn’t one single number that fits everyone. But expected ROI in Dholera Smart City becomes more realistic when you choose the right location, verify documents, enter at a fair price, and hold for a proper period.

If you’re thinking in a 5-year horizon, focus on development progress, connectivity, industrial demand, and legal clarity. That’s the safest way to approach dholera land appreciation in 5 years and build a strong dholera investment return analysis for your portfolio.

📞 Contact Details

Angel Nova Group – Trusted Developer in Dholera Smart City